Discover why credit plays a crucial role in the credit card application process. Understand its importance and implications.

No one likes talking about credit scores or credit. But its the single biggest factor in you being able to get approved for a credit card. While having a good credit score is part of it, understanding what credit card issuers are really looking for is the key to getting approved for credit cards and start racking up those points.

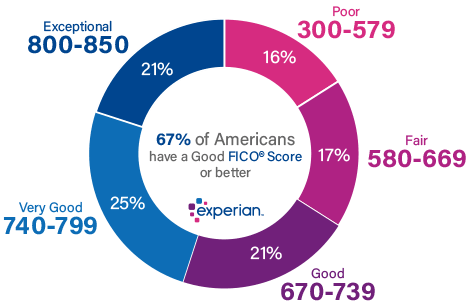

Getting right into it, your credit score is a number between 300 – 850 that essentially says how trustworthy you are at borrowing and paying back money. The higher the score the “more likely” you are at paying debts back.

There are many different scoring models used to calculate credit scored but FICO is one of the top ones. Its compromised of 5 things which are:

Payment History 35%

Outstanding Debt 30%

Credit History Length 15%

New Credit 10%

Credit Mix 10%

Breaking this down you can see that making your payments on time is the biggest impactor on your credit score. Hence, don’t pay your bills late i.e student loans, car and mortgage payment. Outstanding debt is the second biggest contributor to your credit score. I like to think of it like this. Banks love giving businesses money when they don’t need it but as soon as they see they are maxing out their accounts and credit limits the hairs on the back of their necks stand up and the flow of money stops. Same thing here. If you have a bunch of cards and are only using 1% of that total credit, then banks would be happy to give you another card. But start getting over 50% and that starts to signal trouble to them.

Credit history is important. Those credit cards that you opened up when you turned 18, keep them open as they are helping increase your overall credit history age. Always try to see if you can “product change” an annual fee card to a no annual fee card to keep it open. Most card issuers will have a no annual free option or downgrade path. Last thing we want is to close a card that we’ve had for years just to lower our credit score.

While opening new cards does effect your credit score its not the end of the world. Yes your score might go down a few points because of a hard pull but the benefits of your overall credit increasing outweighs the slight hit that you’ll take.

Don’t get discouraged if you don’t have the best of credit. It takes time for it to get better and if you have a couple of negative items on your credit history don’t worry. Those usually fall off after seven years so there’s always time for your score to improve.

Going back to outstanding debt and credit card usage, having 1k in debt on a card with a 10K limit is very different than having 1k debt on a card with a 2k limit. While its the same amount of debt, on one card you’re only utilizing 10% while on the other its 50%. This might be the difference in your credit score dropping a couple of points or over 70. It’s happened to me in the past so I know. This is why I want to go over credit card due dates and statement close dates.

To keep it simple, your statement close date or statement period comes before your due date. Your due date usually comes 3 weeks after you statement close date. Visualizing it helps me so here’s a quick 30 second video. (LINK)

If you’re tired of your credit score yo-yoing or are getting ready to apply for another card make sure you pay down your balance before your statement close date not your due date. This is especially crucial when you know you’re putting a big purchase on your card but are going to pay it off. Don’t wait for the due date because it’ll bring down your score until your next statement closes and it gets reported.

The last thing I wanted to go over in this email was Chase 5/24. You might have heard about it but if you haven’t its simple. Its somewhat of an unspoken rule that Chase has. They’ve become a little more lenient on it with their co branded cards but it’s still around. You’ll get denied for any Chase card if you’ve opened five or more personal credit card within the span of 24 months. The thing that sucks about this is that the five cards don’t even have to be Chase cards. So if you’ve opened up 5 cards in the past two years lets say two from Amex, one from Citi and another two from Capital One. You’ll be automatically denied from getting any Chase card until two years have passed from your last card.

Business cards don’t count towards 5/24 but you still have to be below 5/24 in order to be approved for any of the Chase business cards which also sucks. This adds a little bit of strategy into your credit card journey. You have to map out what cards you want in order to stay below 5/24 or make sure you get all the Chase personal and business cards you want before hitting 5/24.

For me, I’ve made sure to stay below 4/24 in order to still be approved for some Chase business cards given that I could potentially apply for as many variations or co branded business cards and won’t exceed 5/24.

If you liked this blog post, sign up for my newsletter where I help you maximize your points and miles!